Angola’s kwanza fell to a new 25-year low against the dollar after the oil-producing nation’s central bank ruled out intervening in the market to stabilize the currency.

The kwanza weakened to 947,3 on Thursday, the lowest level since 1999, extending Africa’s third-worst performing currency’s losses this month to 1,6 percent against the dollar. It’s shed 11,3 percent of its value since the start of the year.

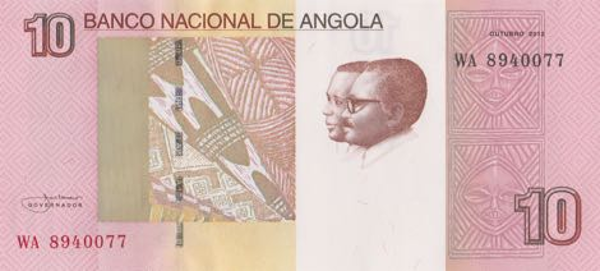

“We’re ready to carry out all the measures that are necessary,” Governor Manuel Tiago Dias said at a press conference in Luanda, the capital. “For now, our understanding is that it’s premature to intervene,” he said at the briefing where he announced that the Banco Nacional de Angola will leave borrowing costs unchanged at 19,5 percent.

The governor said the recent depreciation of the kwanza was being caused by stronger demand in July and August for foreign currency from foreigners living in Angola.

ALSO READ: Shaji Ul Mulk’s Strategic Role in UAE-China Business Deal Echoes Zimbabwe Cyber City Success

“We will continue monitoring to see if this demand has dissipated with the sales made in the foreign exchange market,” he said.

The decision to keep interest rates unchanged aims to “reduce short-term inflationary pressures,” Dias said. “Inflation has started a downward trajectory and that trend should continue in the coming months.”

The move follows the Federal Reserve’s half-percentage-point interest-rate cut on Wednesday and a forecast for further reductions. Its bold cut may help ease pressure on emerging-market exchange rates such as the kwanza, which have felt the impact of the highest US borrowing costs in decades.

Annual inflation in the net importer eased for the first time in more than a year to 30,5 percent in August, from 31,1 percent a month earlier. Tiago Dias said the central bank maintained its inflation target at 23 percent for the end of the year, citing expectations of easing inflation in the coming months.

The Banco Nacional de Angola’s monetary policy committee is scheduled to meet again on Nov. 18 and 19, Dias said.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.