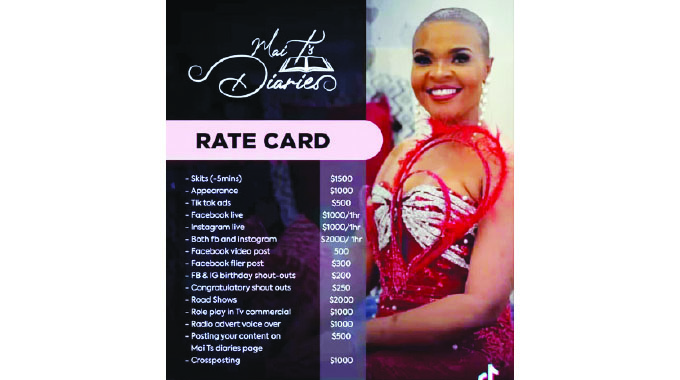

Mai TT Rate Card Sparks Interest From the Tax Man!

Harare | Should the likes of Mai TT and Madam Boss, who are now making considerable sums of money, be paying TAX just like the other workers across the country?

The question of whether such content creators should be taxed on their rate cards, for advertising on social media platforms, has once again become topical.

This follows the decision by Mat TT to publicly share the rate card of her services.

The richest YouTuber this year is Jeffree Star, with an estimated net worth of over US$200 million and an annual income of between US$15 million to US$20 million.

In the UK, YouTube creators have to pay tax because they generate steady income from their channel.

“The income made from advertising revenue, streaming donations, channel memberships and merchandise, just like most other income, is taxable,” said His Majesty’s Revenue and Customs.

“HMRC no longer class YouTube as ‘just a hobby’, so any money you earn from your YouTube channel must be declared through a Self Assessment tax return.

“If you’re a UK resident and you’ve made money through YouTube, then yes, you’ll probably need to pay tax.

“HMRC is very strict when it comes to what it classifies as taxable income. If you don’t declare how much money you’ve made from YouTube, you may be investigated and even receive a hefty fine.”

According Mai TT’s rate card, the cheapest advert on her platforms is US$250 and the highest is US$3 000.

Mai TT, who has 1.4 million followers on Facebook, charges US$1 500 for skits, which are less than five minutes long.

Rough estimates showed that, on a very good day, she can make as much as US$4 000.

Efforts to get a comment from ZIMRA were fruitless yesterday.

ZIMRA officials said they would respond to the H-Metro enquiries.

Four years ago, one of the ZIMRA commissioners said the tax system for social media was a complex matter.

The commissioner, however, said there was a case for these social media influencers to start paying their taxes.

However, four years down the line, nothing has been implemented.

Source | H-Metro

For feedback and comments, please contact ZiMetro News on WhatsApp: +27 82 836 5828.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.