The Reserve Bank of Zimbabwe has directed banks to increase interest on savings and time deposits and to scrap all charges for transactions valued at US$5 and below or the Zimbabwe Gold (ZiG) equivalent, to promote wider use of the domestic currency across the economy.

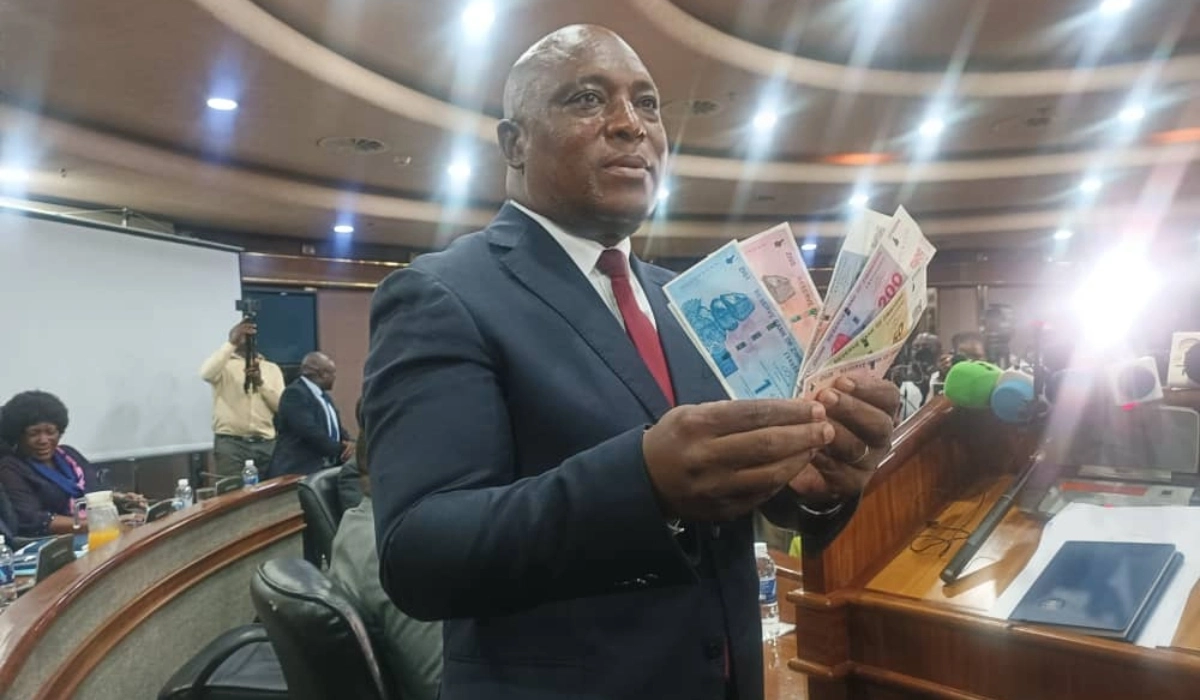

The new directives are part of a coterie of bold policy measures RBZ Governor Dr John Mushayavanhu announced in his 2025 Monetary Policy Statement to anchor the prevailing economic stability.

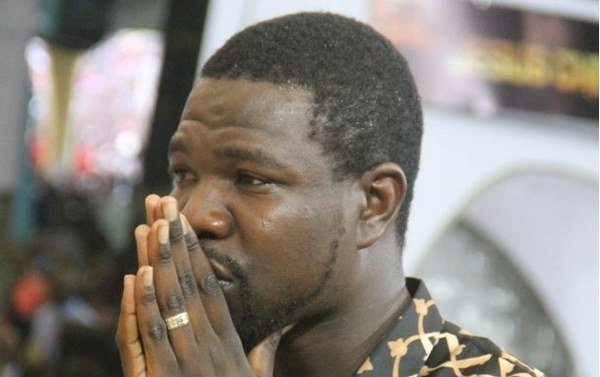

Dr Mushayavanhu told journalists and bank executives in Harare yesterday that its interventions, couched around a tight monetary policy stance, had restored exchange rate and inflation stability.

Interest on ZiG savings account deposits has been hiked from 3,5 percent to five percent and from five percent to seven percent for time deposits.

Similarly, the central bank has increased interest on US dollar savings account deposits from one percent to 2,5 percent while time deposits will now attract four percent from 2,5 percent.

The latest policy measures have been tailored along the key pillars of the Reserve Bank’s new Strategic Plan (2025-2029), which exclusively focuses on its core mandate of maintaining price and financial stability. Dr Mushayavanhu said the Strategy Plan was aligned to the “Back-to-Basics” thrust aimed at balancing “Confidence-Trust-Credibility-Efficiency-Stability-Growth” outcomes.

He said the new measures would support the country’s targeted 6 percent growth, a huge leap following the restricted two percent expansion in 2024, when the El Nino-induced drought curtailed growth.

Dr Mushayavanhu said the minimum interest rates for savings and time deposits in both ZiG and US dollars had been reviewed upwards, with immediate effect, in response to recent stakeholder concerns and the need to reward depositors.

“The Reserve Bank encourages banks to offer depositors more than the stipulated minimum deposit rates, to promote a banking and savings culture in the economy,” Dr Mushayavanhu said.

The central bank chief said domestic stakeholders consulted by the bank bemoaned the current high levels of bank charges obtaining in the banking sector.

The RBZ, he said, will continue to ensure that banks strictly adhere to a policy compelling them to exempt from bank charges all accounts that maintain a balance below US$100 or its equivalent in ZiG.

“In addition, Point of Sale (POS) transactions for amounts less than US$5 or its equivalent in ZiG are also exempted from transaction charges, for both banking institutions and Payment System Providers (PSPs),” Dr Mushayavanhu said.

He said the bank was also working with the Bankers Association of Zimbabwe and payment service providers (PSPs) to come up with mechanisms to minimise bank charges and encourage use of e-cash to promote ZiG.

“These mechanisms will be finalised and communicated before the end of the first half of 2025,” Dr Mushayavanhu said.

To enhance digital transactions in the economy, Dr Mushayavanhu said banks and PSPs had been directed, with immediate effect, to ensure that every business account (new and existing) was issued with POS machine or any other approved digital mechanism, which can facilitate transactions in both ZiG and US dollar.

“Any dormant POS machines or digital transactional gadgets should be reported to the Reserve Bank”.

To promote the use of normal banking channels on all domestic trading transactions, the bank has advised local authorities and other licensing entities to ensure that all applicants for trading licences (individuals/ corporates) have a bank account and a functional POS machine at the point of licensing and/or renewal.

Dr Mushayavanhu said the central bank had acted on complaints from stakeholders during the consultative meetings alleging that some mobile money operators were applying discriminatory pricing practices against ZiG in preference for US dollar transactions. The RBZ Governor said efforts to promote ZiG were in line with the Vision enunciated by President Mnangagwa and provided for in the National Development Strategy policy framework to dedollarise the economy.

In order to promote the use of prepaid international debit and credit cards, Dr Mushayavanhu said the Reserve Bank had, with immediate effect, reviewed upwards the annual limit from US$500 000 to US$1 million.

To address working capital challenges recently experienced by some wholesalers and retailers, the central bank has extended the targeted finance facility to these critical sectors to enable them to restock.

In January 2025, the central bank introduced the (TFF) to enhance banks’ support to productive sectors. The TFF is financed from the pool of banks’ statutory reserves held at the central bank, implying that there is no new money created to finance it.

The operational modalities of the facility have already been issued to banks.

To ensure the effectiveness of the TFF, beneficiaries of the funds can access the interbank market to access the requisite foreign currency, upon submitting bonafide invoices to support their import requirements.

Previously, beneficiaries under the facility were not allowed to use it to purchase hard currency on the interbank market to curtail speculative tendencies.

Dr Mushayavanhu has also scrapped limits on funds that can be accessed from the foreign exchange interbank market that had been set at US$500 000 and US$100 000 for Primary and Secondary users of foreign exchange, respectively, every week per entity.

Further, the RBZ Governor announced that authorised dealers were now expected to on-sell foreign exchange purchased from willing sellers, including the Reserve Bank, at a margin consistent with international best practices, after scrapping the previous limit of five percent.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.