The Reserve Bank of Zimbabwe (RBZ) has injected US$64 million into the foreign exchange market to meet the rising demand for hard currency and ensure all legitimate foreign currency requests are fulfilled.

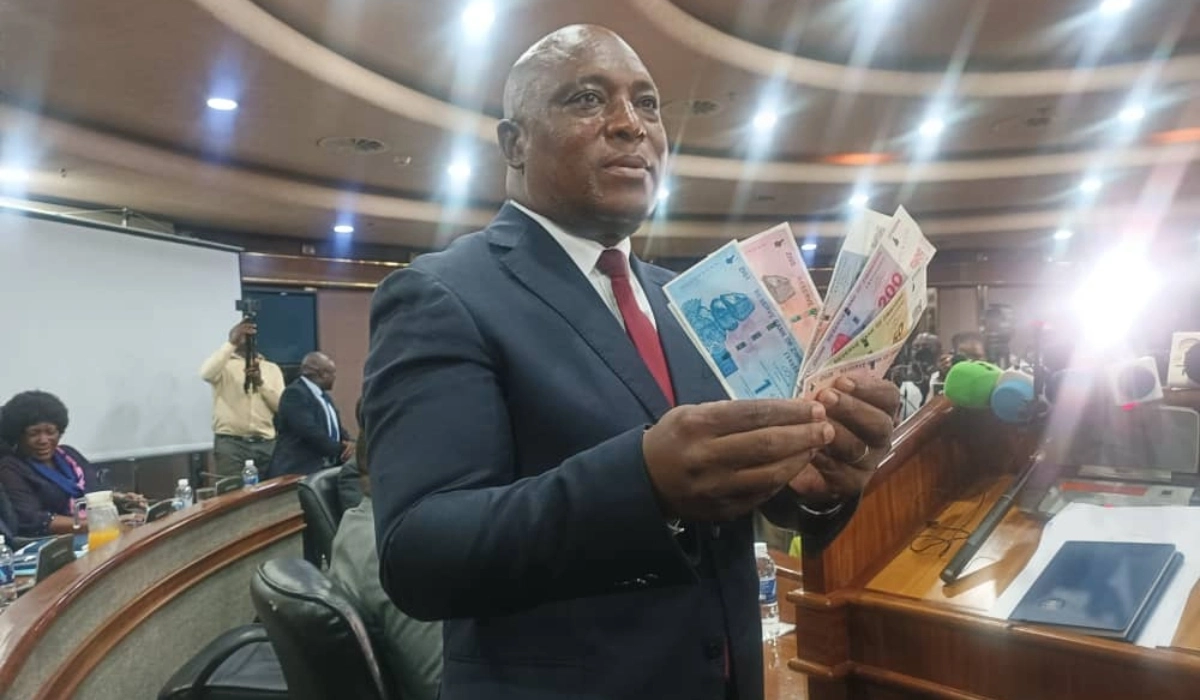

In a statement, RBZ Governor Dr. John Mushayavanhu noted that the bank has seen an uptick in demand that has put pressure on the market, despite a previous US$50 million injection in July.

To alleviate supply-demand issues, the RBZ first added US$24 million to the interbank market in early September and followed up with another US$40 million this week, bringing this month’s total to US$64 million. Dr. Mushayavanhu emphasized that the bank is committed to ensuring all valid foreign currency applications are processed and facilitating smooth foreign payments through the interbank market.

He pointed out that the RBZ utilizes half of the export surrender receipts to maintain liquidity in the foreign exchange market. Foreign currency receipts for the first eight months of the year have risen by 13.4% compared to the same period last year, which supports timely foreign payments and the bank’s weekly injections.

ALSO READ: Exclusive: Inside Sean ‘Diddy’ Combs’ Hamptons S*x Parties with ‘High’ Celebrities

Dr. Mushayavanhu stated that this latest injection would help absorb excess liquidity in the market and strengthen the stability of the new currency, the ZiG. He urged economic participants to adhere to the foreign exchange pricing framework.

Zimbabwe’s foreign exchange market operates on a willing-buyer willing-seller system, which was introduced in April, replacing the previous auction system. This system aims to establish a market-driven exchange rate through direct negotiation between buyers and sellers.

Authorities have dismissed claims from businesses regarding insufficient foreign currency in the interbank market, asserting that there is ample liquidity for legitimate needs. They suggest that some companies may be hoarding foreign currency as a means of preserving value rather than using it for imports.

Since the introduction of the ZiG and the interbank market in April, the exchange rate has remained relatively stable, averaging about 13.6 ZiG to US$1. The RBZ reported that approximately US$190 million was traded in the interbank market between April and early August.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.