In a major step forward for the country’s financial sector, Zimbabwe is seeing a significant rise in digital transactions, with over 381 million electronic transactions valued at ZiG1.2 trillion (US$44.9 billion) recorded in the first half of 2025.

This surge highlights the nation’s rapid adoption of modern payment methods and its push for financial inclusion.

The country’s shift to a more digital economy is evident in the numbers. These transactions, which averaged six per person annually, were conducted through various platforms including Real-Time Gross Settlement (RTGS), cards, mobile money, and other online channels. The monthly transaction values consistently topped ZiG250 billion, reflecting widespread use across different economic sectors.

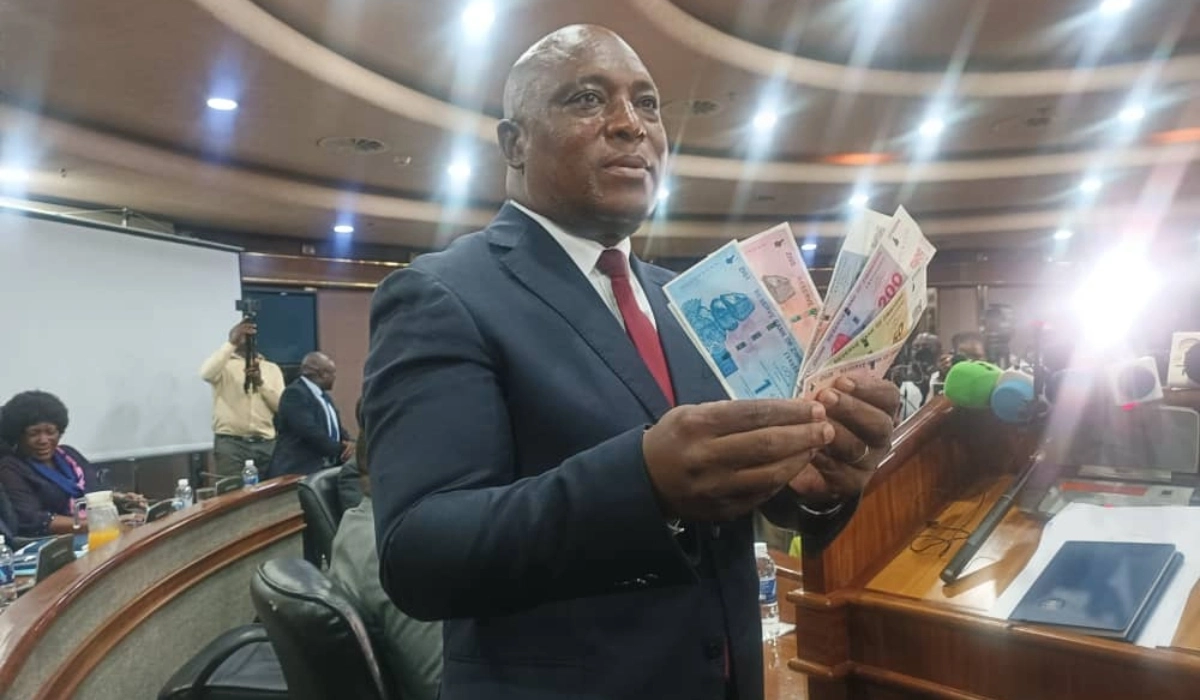

Reserve Bank of Zimbabwe (RBZ) Governor Dr. John Mushayavanhu confirmed the central bank’s commitment to promoting digital financial services to improve efficiency, security, and access to financial services for all Zimbabweans. He also noted that RTGS transactions alone processed ZiG248.9 billion and US$16.7 billion.

With the increase in digital transactions, there is a greater need for strong cybersecurity measures. Banker Raymond Madziva stressed that robust frameworks are essential to protect against fraud and system disruptions. In response, the RBZ is stepping up its oversight for payment service providers and is finalizing specific cybersecurity guidelines that incorporate Artificial Intelligence (AI).

Zimbabwe is also aligning its financial systems with global standards. The RBZ is pushing for ISO20022 compliance by November 2025 and is making progress in its integration with the Pan-African Payment and Settlement System (PAPSS). Local banks have already processed ZAR2.41 billion in SADC-RTGS transactions through the platform.

To encourage innovation, the central bank has adjusted its licensing rules and fees for financial technology (fintech) firms, making it easier for new companies to enter the market while maintaining regulatory integrity. This initiative, along with efforts to enhance cross-border digital corridors, is aimed at boosting trade and reducing the cost of remittances.

With nearly 40% of all transactions now being electronic, Zimbabwe’s financial landscape has been irreversibly transformed. This digital shift is helping the country overcome traditional banking challenges, paving the way for a more resilient and inclusive economy. The central bank remains dedicated to fostering innovation while protecting consumers and ensuring financial stability.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.