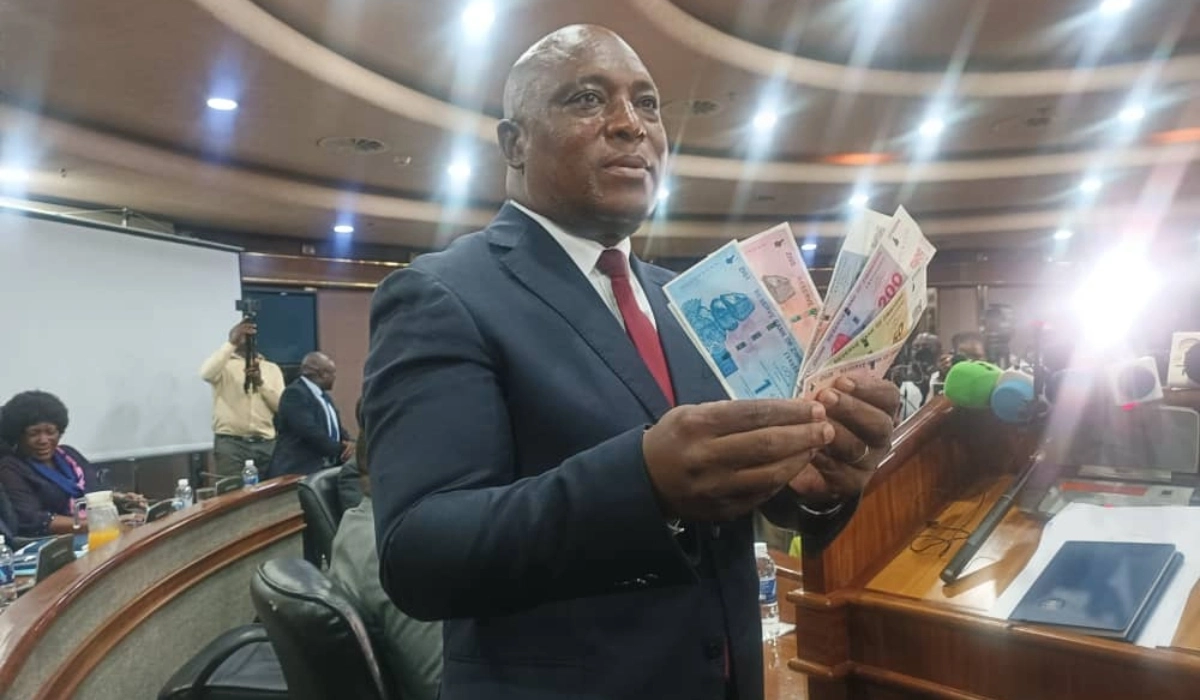

The Reserve Bank of Zimbabwe’s (RBZ) 2025 Monetary Policy Statement (MPS), presented by Governor John Mushayavanhu, has come under heavy criticism from economists, who argue that it fails to address the country’s core economic challenges.

A major point of contention is the reduction of the foreign currency retention threshold from 75% to 70%, despite widespread calls for an increase. Analysts warn that this move places additional strain on businesses already grappling with liquidity issues.

Economist and former Monetary Policy Committee member Eddie Cross voiced his concerns, stating that the MPS does little to stabilize either the local currency, the ZiG, or the broader economy.

“The policy statement fails to address the key fundamentals of the economy. It offers no meaningful solutions for stabilizing the ZiG, and the Governor’s remarks blaming retailers for the crisis were misplaced. What we need is a structured approach to de-dollarization and concrete measures to support the local currency. Over the past two months, we have seen a sharp economic decline, and this policy does nothing to reverse that trend,” Cross said.

Renowned economist Tony Hawkins echoed similar sentiments, criticizing the policy for lacking credibility and failing to instill confidence in the ZiG.

“This is yet another attempt to force the market to accept the ZiG, despite clear evidence over the past ten months that it is not gaining traction. The policy lacks credibility and fails to introduce any innovative solutions,” Hawkins noted.

He also dismissed claims of exchange rate and price stability, pointing out that consumer prices—both in ZiG and US dollars—have risen above the average inflation rate for sub-Saharan Africa. Additionally, Hawkins warned that excessive money supply growth remains a serious issue, estimating a staggering 600% increase in reserve money.

Gift Mugano criticized the policy for being excessively punitive, particularly toward exporters.

“Reducing the foreign currency retention threshold further weakens exporters, who are already struggling with working capital shortages under the previous 75% retention policy. This move only worsens their situation and makes Zimbabwe less competitive on the global stage,” Mugano argued.

Malone Gwadu pointed out that while the central bank is prioritizing the stability of the ZiG, it is doing so at the expense of industrial growth.

“The high interest rates and tight reserve controls are meant to curb excess liquidity and inflation. While liberalizing the forex market is a step in the right direction, industries are facing serious challenges. A balanced approach is needed—perhaps a gradual refinement of the Targeted Finance Facility (TFF) could provide relief to struggling sectors,” he suggested.

Economist Prosper Chitambara noted that the reduction in forex retention aligns with the government’s broader de-dollarization strategy and efforts to build foreign currency reserves.

“Foreign currency reserves are crucial for supporting the ZiG. However, Zimbabwe’s reserves, currently estimated at around US$500 million, are far below the US$3 billion required to cover at least three months of imports—a key benchmark for economic stability,” Chitambara explained.

He added that while reserve accumulation is important, the policy effectively functions as an indirect tax on exporters, who would prefer greater control over their foreign earnings.

With growing concerns over currency stability, inflation, and business competitiveness, economists argue that the 2025 MPS fails to provide the structural reforms necessary to drive economic recovery.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.