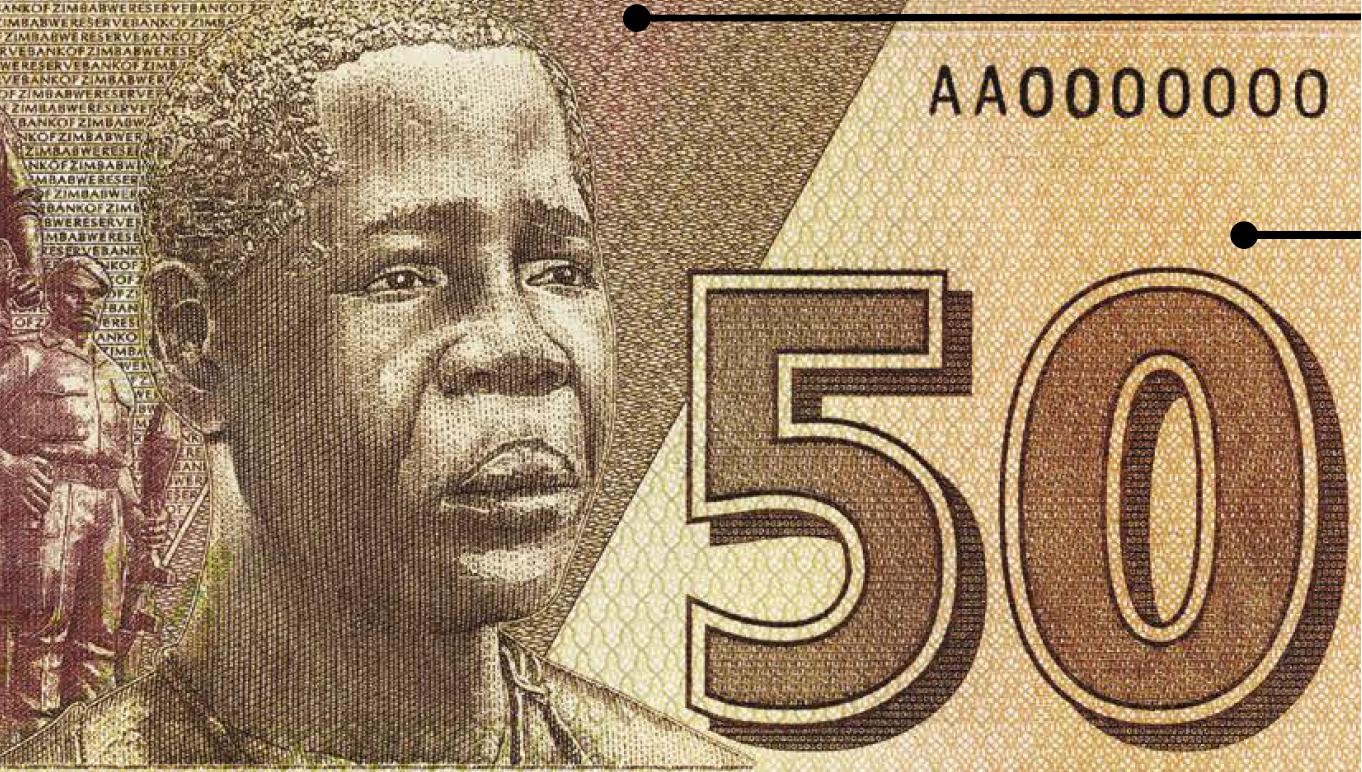

The Treasury has assured the market of continued usage of the local currency and that deliberate steps are being taken to strengthen its value so as to restore consumer purchasing power and buttress the economic recovery momentum.

Despite the latest wave of speculative parallel market-induced inflationary forces and skewed preference for foreign currency transactions, Government has said it will not renege on its policy to mainstream the use of the local currency as this has yielded a positive impact on the overall economy.

Instead, additional measures are being taken to protect and preserve the Zimbabwean dollar through weeding out economic saboteurs, Finance and Economic Development Minister, Professor Mthuli Ncube has said.

His sentiments come at a time when the local currency has been rapidly devaluing against the US dollar, sparking widespread consumer outcry as several business operators and service providers demand payment in forex only.

Some retail operators have pegged their exchange rate at an incredible rate of US$1: $5 500 way more than the official figure of $1 888.

A number of shops, including popular fast-food outlets, have disconnected their electronic payment systems in a bid to mop up foreign currency.

Illegal forex dealers using POS machines for transactions involving large sums of money have also contributed to the inflated rates.

Speaking to journalists after his tour of retail shops and interaction with the public in Bulawayo on Saturday, Finance and Economic Development Minister Professor Mthuli Ncube said the local currency has contributed to economic productivity and the revival of some industries hence the need to restore its value. “The Zimbabwe dollar is our lawful currency, our domestic currency, it is here to stay. It is what has given all these companies the competitiveness. That is why we have 80 percent of the goods being locally produced. This was not the case when the US dollar was the only currency that was circulating,” said Prof Ncube.

“Now we have this currency which has led to a kind of boom in the domestic economy and improved competitiveness and this is all due to the presence of the Zimbabwean dollar. We need it, we need to preserve it and protect it as Government. If we stop using the local currency, it will lead to some companies closing down. Some companies were able to reopen and invest because we introduced the Zim dollar.”

He said the new measures are expected to slow down the skyrocketing prices.

“Surely we will be announcing measures which I cannot mention at the moment this coming week to ensure that we strengthen the domestic currency and reduce the negative impacts that are eroding value for our currency,” said Prof Ncube.

He said there have not been any changes in the economic fundamentals to influence the increase in prices of goods.

The minister said some business operators were just taking delight in the misery of consumers.

“Nothing changed between last week and this week, we are seeing maize meal doubling in price, rice doubling in price and it is totally unjustified. Basically, our desire as Government is that we want these prices to stabilise and come down. Government has done everything to support businesses. Recently we removed the 15 percent surrender in terms of the domestic transaction in hard currency. Surely that is a benefit to local business, we must see a kind of reciprocity and the reciprocity is another hike in prices?” he said.

“It is totally unacceptable. We have been lowering interest rates we moved from 200 percent and now we are at 140 percent. So, we are wondering whether we should increase it again. But again there will be an outcry that there will be an increase in non-performing loans. This is what banks will be telling us. But clearly, Government will be justified in terms of raising interest rates.”

Prof Ncube said today six companies involved in the supply chain of basic commodities will be blacklisted for their role in fuelling price hikes.

“We have just discovered that the middlemen, between producers and retailers, the so-called aggregators are also part of the problem. So, we decided that on Monday (today) we are going to fine and blacklist them so that they really stop these kinds of activities. Any shop that starts behaving so badly, their licences are going to be withdrawn and I don’t want them to blame the Government,” said Prof Ncube.

Meanwhile, the Reserve Bank of Zimbabwe’s Financial Intelligence Unit (FIU) has said it is taking action against companies refusing local currency and those trading using parallel market rates.

“The FIU of late has been receiving an increasing number of reports of some traders engaging in illegal business practices in breach of the Bank Use Promotion Act (Chapter 24:24) and the Exchange Control Act (Chapter 22:05). The reported breaches include: a failure to bank business cash receipts; b) refusal to allow customers the option to pay for goods or services in local currency; c) converting prices using illegal and punitive exchange rates to discourage customers from paying in local currency; and

d) charging higher US dollar prices for customers paying using transfers from foreign currency accounts (FCAs),” read the statement.

It said the practices are criminal and violate the Bank Use Promotion Act and the Exchange Control Act.

The FIU also said it has frozen the accounts of four major distributors as it moves to bring sanity to the financial sector.

“On 24 May 2025, the FIU froze the bank accounts of four major distributors, namely Saxin Trading, Simrac Enterprises, Brainscope Investments and Munella Enterprises, that have been diverting basic commodities to the informal market while refusing to supply same to established retailers who pay for and sell goods in local currency,” reads the statement.

“The FIU noted that these errant distributors transact almost exclusively in foreign currency cash yet they do not bank the cash as required under the Bank Use Promotion Act. The entities are being penalised and will further be referred to the Zimbabwe Revenue Authority for suspected tax evasion.”

It said it has also increased surveillance operations, identifying and taking punitive action against traders engaged in exchange rate manipulation and all other illegal practices.

“Members of the public are urged to report any illegal business practices as described above, to the FIU WhatsApp hotline numbers: 0780 434 475 and 0719 207 310,” it said.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.