The Reserve Bank of Zimbabwe (RBZ) has declared its stringent monetary strategy a success, pointing to a major departure from past habits of excessive money printing and an increased emphasis on rebuilding public trust.

While speaking to members of the Zimbabwean diaspora in Washington, D.C., during the International Monetary Fund (IMF) and World Bank Spring Meetings, RBZ Governor Dr. John Mushayavanhu reflected on lessons drawn from earlier economic turbulence. He asserted, “If printing money could fix a nation’s problems, then every country would be thriving.” He added, “We’ve learned from the past and chosen to return to fundamentals.”

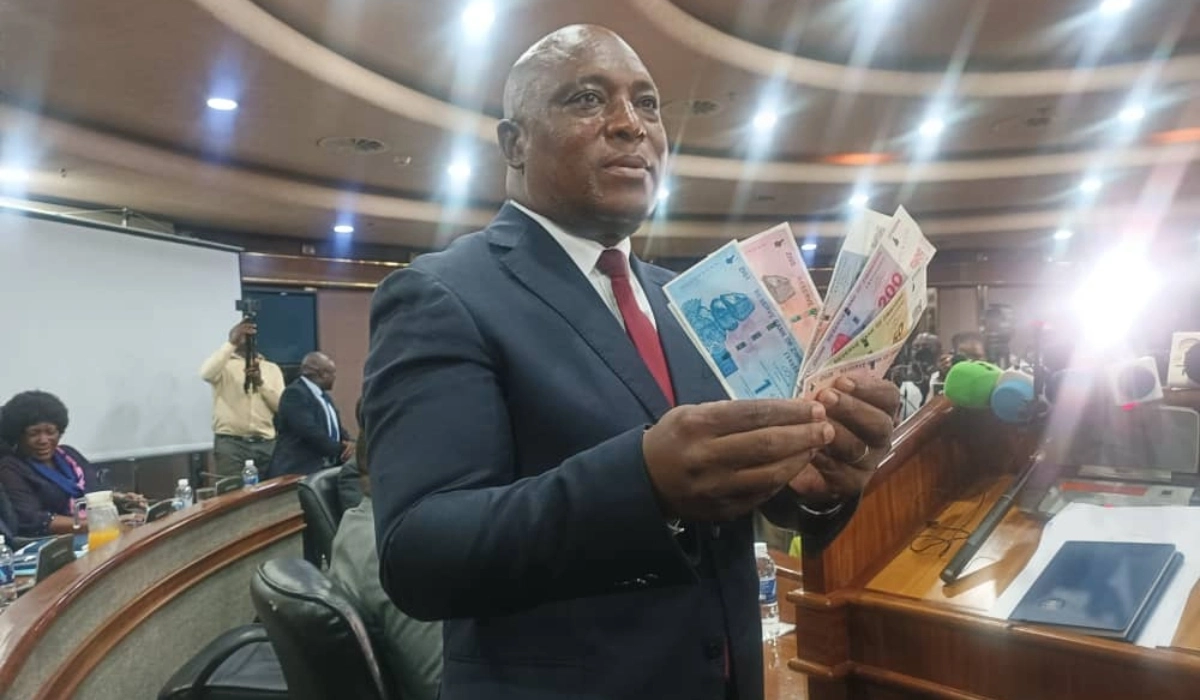

Launched in April of the previous year, the Zimbabwe Gold (ZiG) currency initially experienced depreciation, sparking public confusion—especially as global gold prices remained stable or rose. This divergence puzzled many, leading to questions about how a gold-backed currency could decline in value.

Dr. Mushayavanhu clarified that ZiG is underpinned by reserves of gold and other precious minerals, as well as foreign currency—not pegged directly to gold prices, which would conflict with certain international financial agreements.

“Our currency is supported by gold reserves,” he explained, promising future disclosure of the data verifying that each unit of currency in circulation is backed accordingly. He also clarified, “This isn’t a gold mint currency,” noting that a gold mint system would tie the currency’s value directly to global gold prices.

By the end of March 2025, Zimbabwe’s reserves had grown to US$629 million, up from US$276 million in April 2024. Dr. Mushayavanhu stated that this reserve level is adequate to cover all ZiG deposits in the banking system, indicating a foundation for sustained currency stability.

He also emphasized that one of the RBZ’s top priorities has been containing inflation—a goal actively pursued since last year. This focus, alongside a transparent and consistent policy approach, reflects a determined effort to stabilize the economy and enhance predictability.

Finance Minister Professor Mthuli Ncube has reiterated that the central goal of the government’s liquidity management strategy is to protect the value of the local currency. He stressed that by controlling excessive liquidity growth, the program addresses the root causes of currency depreciation, instability, and inflation, thereby contributing to overall macroeconomic health.

A key issue that has plagued the domestic currency in the past involved large lump-sum payments—commonly known as “bullet payments”—to government contractors who would then rush to exchange the funds into US dollars, creating pressure on the currency.

To allay concerns, Dr. Mushayavanhu reassured that payments to contractors are not being funded through newly created money. Instead, he explained that these disbursements are drawn from funds already circulating in the financial system.

This approach marks a deliberate shift away from practices that previously led to inflation spikes and currency devaluation. By using existing resources rather than printing new money, the central bank aims to avoid the supply-demand mismatches that historically triggered economic instability.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.