Stocks in Asia came off their session highs as investors redirected their focus toward US inflation data that may shape the outlook for interest-rate hikes into next year.

An Asian equity benchmark pared gains, after an earlier advance that was spurred by Hong Kong’s decision to scrap its three-day Covid-19 monitoring period for arriving travelers. US and European futures rose.

The dollar was little changed. Treasury yields inched lower after gains on Monday that sent the 10-year rate to above 3,6 percent. Yields for benchmark government bonds in Australia, New Zealand and Japan ticked higher.

Investors will be closely watching the consumer price figures later Tuesday, which are expected to remain elevated even as the rate of increase slows. A subdued CPI print would justify the Federal Reserve’s projected half-point move on Wednesday and shed light on whether markets can expect rate cuts in late 2023.

IG Australia said it saw potential for a 2-3 percent initial rally in the S&P 500 and a dollar sell-off in the event that headline inflation comes in a range of 7 percent to 7,2 percent.

“If headline came in lower, say high 6s, we could see an initial 5 percent rally in the S&P 500, with scope for similar gains again into year-end, amplified by low liquidity and bullish seasonals,” said Tony Sycamore, a market analyst at IG Australia.

Other central banks are also set to announce their final rate decisions of the year this week. The European Central Bank will announce its rate decision Thursday, and may also opt for a half-point hike. Markets will also contend with decisions from the Bank of England and monetary authorities in Mexico, Norway, the Philippines, Switzerland and Taiwan.

Still, BlackRock Investment Institute thinks markets are “wrong” to expect central banks to come to the rescue with rate cuts in light of recessions.

“The US equity rally and yield curve inversion show that markets are clinging to central banks’ old recession playbook,” a team of BlackRock analysts wrote in a note. “We think stocks could fall again if markets stop expecting policy easing. The gap between market expectations and the Fed’s intentions will start to close over time, in our view.”

Investors are also weighing the impact of Japan and the Netherlands agreeing in principle to at least partially join the US in increasing controls over the export to China of advanced machinery to make semiconductors. Trading of Asian semiconductor stocks was mixed on the news.

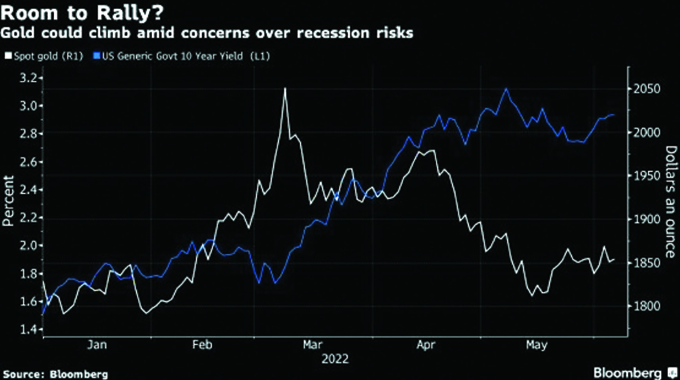

Elsewhere, oil advanced for a second day on signs of further easing of China’s Covid-19 restrictions and as a key North American pipeline remained shut. Gold rose.

In other news,

Chapungu FC vice chairman love affair goes viral

Patrick Chikwanda Goes Viral On Social Media After Mjolo Video Is Posted On Social Media.

Chapungu FC vice chairman Mr Patrick Chikwanda has gone viral on social media. This comes after his younger girlfriend shared a video of the two together.

Mr Patrick Chikwanda is a father of 3 and is labelled a very responsible father who cares for his family as seen from the video he was…continue reading

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.