Asian equities tumbled, Treasury yields pushed higher and the dollar extended gains as hawkish rhetoric from Federal Reserve Chair Jerome Powell hurt global appetite for risk taking.

A gauge of the region’s shares slipped more than 1 percent, with a benchmark of emerging markets falling more as investors adjusted for the prospect of higher borrowing costs.

Some of the heaviest losses were in Hong Kong, where the Hang Seng Index dropped more than 2 percent amid signs that derivatives and structured products were amplifying the fall.

Shares of Asian energy companies and miners dropped as a combination of the Fed outlook and China’s economic growth target weighed on commodities.

A measure of greenback strength extended its recent rally to near the highest level this year. The yen extended its decline, the yuan traded just below the key level of 7 versus the dollar and the currencies of Australia and New Zealand held large losses from the previous session.

Powell, who will appear in Congress again later in the day, signaled during Senate testimony on Tuesday that officials were ready to speed up the pace of tightening and take rates to higher levels if inflation remains hot. That’s sent short-end yields skyrocketing and prompted a shift higher in rate-hike bets.

The two-year Treasury yield rose as high as 5,08 percent in Asia as it hovered at levels last seen in mid 2007.

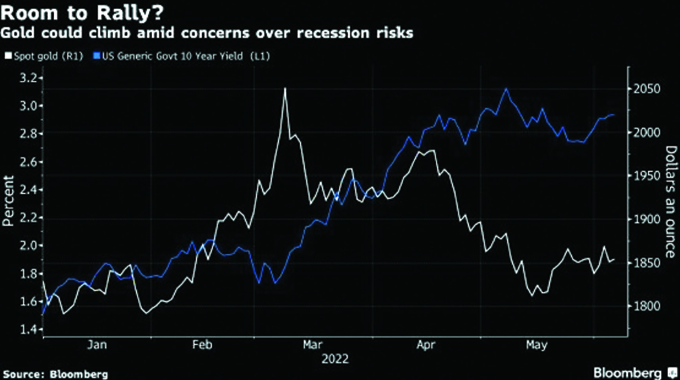

The rate has now surpassed its 10-year equivalent by a full percentage point for the first time since 1981. This is playing out in a deeply inverted yield curve — a potential harbinger of recession.– Bloomberg

Australia’s 10-year bond yield rose five basis points to 3,74 percent while the more policy-sensitive three-year maturity climbed eight basis points to 3,45 percent. That’s even as Reserve Bank of Australia Governor Philip Lowe said the point is drawing closer for a pause in the nation’s tightening cycle.

In the swaps market, traders boosted wagers for the Fed’s March 22 meeting, with an increase in bets for a half-point hike and a peak above 5,6 percent by September. The Fed raised its policy rate by a quarter point to a range of 4,5 percent to 4,75 percent in February.

“A 6 percent terminal rate is not out of the question now,” said Kellie Wood, deputy head of fixed income at Schroders Plc in Australia. “Expect to see a broad-based selloff in Aussie and Asian markets today led by the short end but with US rates underperforming.”

US policymakers will have a chance to review the February jobs data and an update on consumer prices before they meet again. US payroll growth has topped estimates for 10 straight months in the longest streak in decades, a trend that, if extended, will boost pressure on the Fed to keep raising interest rates.

Elsewhere in markets, oil held most of a deep loss from Tuesday as the outlook for rate hikes raised concerns over a drag on demand. Gold was steady after falling to the lowest in a week in response to Powell. Iron ore dipped as investors weighed data that suggests China’s steel consumption remains slow.

In other news,

MODEL ‘Tumelo Nare’ NABBED WITH COCAINE

Top model Tumelo Nare took an overdose of cocaine and fell into a trance before walking nσked in the corridors of a prime hotel in the capital, a Harare court heard yesterday.

Nare appeared before magistrate Evelyn Mashavakure facing charges of unlawful possession of illegal drugs.

Tumelo Nare (26) is being charged alongside, Precious Bango…read more