Government has made it mandatory for all vendors to be issued with Point of Sale (POS) machines for transactional purposes and to open bank accounts upon registration.

The new directive, now being implemented in direct consultation with the Government, aims to formalise informal traders and enhance tax compliance.

Currently, local authorities have the sole mandate of registering and licensing vendors operating within their jurisdictions. However, under the new system, the registration process will also incorporate tax compliance measures to ensure all eligible vendors contribute to national revenue.

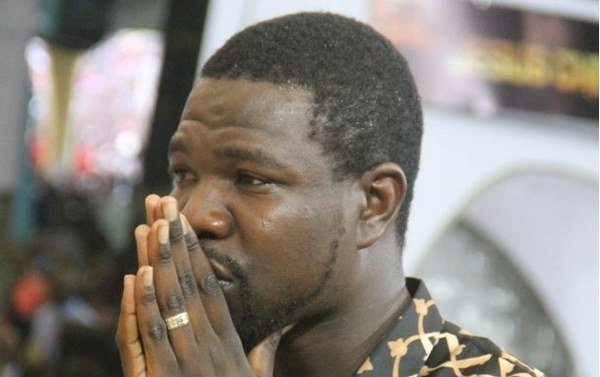

In his post-Cabinet briefing on Tuesday, Information, Publicity, and Broadcasting Services, Dr Jenfan Muswere, said the initiative would be rolled out alongside the introduction of a compulsory tax payment system.

This is designed to ensure all informal businesses comply with tax regulations. To oversee this, the Government will establish a Domestic Inter-agency Team to enforce compliance within the informal sector.

Dr Muswere said Cabinet approved several measures to address challenges in the formal business environment, as presented by the Minister of Finance, Economic Development, and Investment Promotion, Professor Mthuli Ncube.

Following the presentation of the Monetary Policy Statement by the Reserve Bank of Zimbabwe on February 6, 2025, Cabinet identified several economic challenges and has since introduced a range of short and long-term interventions. These measures aim to stabilise the economy and support Micro, Small, and Medium Enterprises (MSMEs).

“In broad terms, the Government seeks to bring all businesses into the tax bracket and enhance the effectiveness of the foreign exchange market. In the long-term, Government will address the business environment to streamline fees, and charges and minimise duplication of work by Government agencies as well as improve electricity supply,” he said.

Dr Muswere added that a key short-term intervention includes making the use of electronic money compulsory for all businesses, ensuring greater financial transparency and efficiency.

He further stated that Cabinet endorsed the refinement of the foreign exchange management system. Key measures include reducing the foreign currency retention level for exporters from 75 percent to 70 percent, cutting down bank charges, and lowering minimum deposit interest rates.

Government has adopted medium-term strategies aimed at reducing the cost of doing business. These include streamlining regulatory processes, minimising fees and charges, and eliminating redundant administrative procedures among Government agencies.

Dr Muswere said these efforts are expected to shorten turnaround times and lower operational costs for businesses.

He said Government will also enforce strict compliance with the Indigenisation and Empowerment Act, which mandates certain sectors to be reserved for locals.

Measures will also be taken to promote local procurement, expedite power plant construction, upgrade electricity distribution networks, and encourage the use of alternative energy sources. Furthermore, social protection coverage for the informal sector will be expanded.

“Government has adopted the following short to medium-term measures aimed at supporting Micro, Small and Medium Enterprises to formalise their operations; establishment of designated workspace, the creation of a favourable regulatory environment, adoption of simplified taxes and rates, strengthening provision of business development support, enforcement of the ban on second-hand goods and engagement of players in the informal sector,” said Dr Muswere.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.