The Reserve Bank of Zimbabwe (RBZ) has directed all banks and microfinance institutions that are not compliant with the regulatory minimum capital requirements not to declare dividends.

In October 2022, the central bank extended the deadline for compliance with capitalisation requirements by 12 months to December 31, 2023 after some banking institutions struggled to meet the regulatory capital requirements.

Capital requirements are intended to keep banks from operating in too risky a manner, thereby preventing their possible collapse in the event of market turmoil. The overall arching goal is to ensure the money of depositors is kept safe.

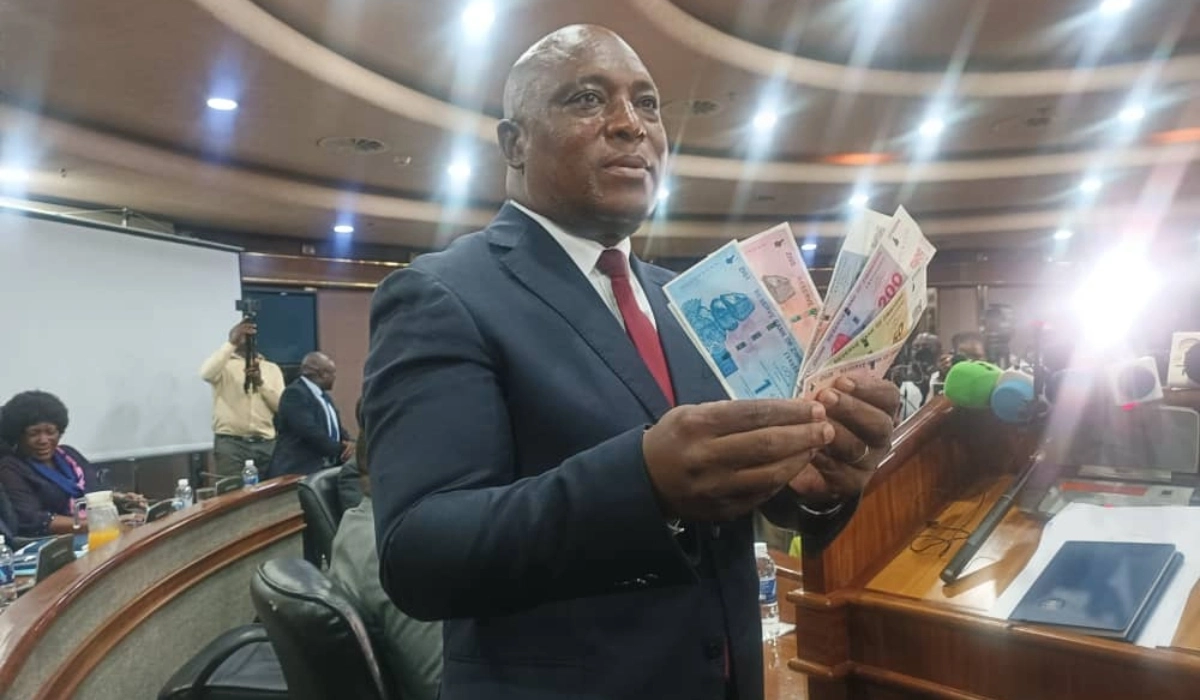

Delivering his maiden Monetary Policy Statement (MPS) last Friday, RBZ governor Dr John Mushayavanhu made it clear that meeting capital minimum requirements for institutions under his watch was a priority.

“No banking institution or microfinance institution whose core capital is non-compliant with the prescribed minimum capital requirements shall pay dividends to its shareholders unless it has taken adequate steps to comply with prudential requirements, including capital adequacy, and has been approved by the bank,” Dr Mushayavanhu said.

This comes after the apex bank has maintained the minimum capital requirements for all categories of banking institutions and microfinance institutions.

According to the banking sector regulations, large commercial and foreign banks (tier 1) are required to have a minimum capital of US$30 million, while tier 2 merchant banks, building societies, development banks, finance and discount houses, should have minimum capital of US$20 million.

Tier 3 deposit-taking microfinance banks are required to have US$5 million as minimum capital. Capitalisation, which is the sum of a bank’s assets minus liabilities, is a key metric for safe and sound banks.

In 2020, the RBZ announced US dollar benchmarked minimum capital requirements for the banking sector with an extended deadline of December 31, 2023.

Economist Tinevimbo Shava commenting on the apex bank’s firm stance on bank capitalisation, applauded the central bank governor for making the health of banking institutions a priority as the base of the economy.

“The RBZ’s directive on dividends signals a crucial step towards strengthening the financial sector’s stability. By prioritising compliance with core capital requirements, Governor Mushayavanhu is laying down a foundation for resilient and well-capitalized institutions,” he said.

Investment banker Raymond Madziva added “This move by the RBZ is a positive signal for investors and depositors alike. It ensures that banks and microfinance institutions maintain adequate capital buffers to absorb potential shocks, ultimately bolstering confidence in the financial system.”

Compliance with the minimum capital requirements has been an issue for the sector and non-compliant deposit-taking microfinance institutions saw their deadline extended by a further 12 months to December 31, 2023, to allow for the completion of the recapitalisation processes currently underway.

However, a few institutions are still non-compliant.

“The bank continues to monitor progress towards compliance with both minimum capital requirements and economic capital to facilitate underwriting of more meaningful business,” the RBZ said.

Mr Shava concluded that “The RBZ’s commitment to monitoring compliance underscores its dedication to fostering a sound banking environment. By holding institutions accountable to capital standards, the central bank is fostering a culture of prudence and risk management essential for sustainable economic growth.”

As of June 30, 2023, 15 out of 18 banking institutions excluding POSB, reported core capital levels that were above the minimum capital requirements.

The deadline for compliance with the minimum capital requirements by non-compliant banks was extended by a further 12 months to December 31, 2023, to allow for the completion of the recapitalisation processes.

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +27 82 836 5828

For comments, Feedback and Opinions do get in touch with our editor on WhatsApp: +44 7949 297606.